Rebuilding Afghanistan’s treasury

September 28, 2009 Monday

Rebuilding Afghanistan's treasury

BYLINE: Peter Bergen Sameer Lalwani SECTION: EDIT; Pg. 6

LENGTH: 681 words

ABSTRACT

Taxing foreign contractors would help Afghans recoup aid that gets recycled back to the West.

FULL TEXT

The top American commander in Afghanistan, General Stanley A. McChrystal, is right to warn that efforts to rebuild that country depend on winning the ''struggle to gain the support of the people.'' And few issues do more to stoke the resentment of ordinary Afghans than the tens of billions of dollars of foreign aid from which they have seen little or no benefit. They see legions of Westerners sitting in the backs of S.U.V.'s clogging the streets of Kabul and ask themselves what exactly those foreigners have done to improve their daily lives.

Eight years after the fall of the Taliban, Afghanistan remains one of the poorest countries in the world. And by some estimates 40 percent of international aid leaves the Afghan economy as quickly as it comes in - going to pay Western security contractors, maintain back offices in the West and pay Western-style salaries, benefits and vacations - while as little as 20 percent of that aid reaches its intended recipients.

Compounding this problem, the salaries of imported civilian workers are orders of magnitude higher than those of their Afghan peers. Some employees of the United States Agency for International Development, for instance, earn more than 300 times the monthly pay of an Afghan teacher.

Yes, when it comes to large-scale projects like building roads and hospitals, Western contractors have to take the lead because Afghan companies are years away from having enough experience. But there is a way for the Afghan government to recoup some of the billions of dollars of aid flowing to those contractors and being recycled back to the West: tax it.

Foreign contractors and corporations working in Afghanistan do not pay income taxes there; and if they do pay taxes at all, it is to their home governments. America and its European allies could easily give up claims on taxes from their citizens working in Afghanistan and instead condition contracts so that the workers and the companies that employ them pay Afghan taxes.

The loss in tax revenue suffered by Western countries would be trivial compared to the good will this would engender among Afghans. Right now the government's tax revenues total a paltry $300 million. Taxing foreign technical assistance alone - an estimated $1.6 billion annually - could double this revenue.

And this would require little sacrifice from the 70,000 or so foreigners working in Afghanistan. Afghan taxes are quite low, with the highest bracket set at 20 percent, while technical advisers from Western development agencies can earn $9,000 to $22,000 per month and private contractors can earn even more. With Western unemployment rates high, it is unlikely that having to pay a relatively paltry amount of tax to Afghanistan would deter contractors or corporations from taking on lucrative work there.

The money isn't the only issue: Because it is dependent on foreign aid for about 90 percent of its budget, Afghanistan is fiscally and politically unaccountable to its people. The government needs to build a taxation bureaucracy or it will never develop many of the abilities critical to governance, like budgeting and allocating resources. Since the taxable Afghan population is now tiny - most citizens are either desperately poor or operate within the large black market economy - the quickest path to developing a working revenue system is by taxing the foreign workers and companies.

New tax revenues from foreign contractors should be used, above all, to pay down a substantial portion of the cost of building up the Afghan National Army, which is $1 billion to $2 billion annually. Foreign contractors have a vested interest in helping the army develop, as it will eventually provide the security that will allow them to continue enjoying their lucrative contracts after Western forces eventually withdraw.

While they face risks, contractors in Afghanistan are also faring quite well financially. It's time they returned some of that wealth to the Afghan people.

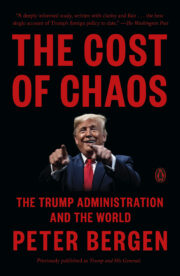

FEATURED BOOK