UPCOMING EVENTS

Institutional Investor, Washington DC

Searching for Yield, Seeking Solutions

Corporate Funds Roundtable – Institutional Investor Institute

The combination of low interest rates and higher-than-expected inflation levels, given the slow growth environment, will continue to pose challenges for investors looking to meet their pension obligations now and in the future. How are plan sponsors responding with regards to the construction of portfolios, plan governance procedures and risk management practices? A series of presentations, workshops and discussion groups will allow participants to exchange ideas with industry leaders and government officials.

Monday, March 4, 2013 (Pre-Roundtable)

Join us for a special Investor-only session: Prior to the official start of the Roundtable, at 5pm on Monday, March 4th, we will be hosting an investor-only private conversation followed by cocktails & dinner at the acclaimed CityZen restaurant, please join your peers.

Investor-only Session/Private Conversation

5.00

Welcome Reception & Dinner for All Delegates at CityZen, Mandarin Oriental

6:00 -8:30

Opened by renowned Chef Eriz Ziebold (Spago, The French Laundry, Per Se) in 2004, CityZen has been awarded and recognized as one of the best restaurants in the country. Join us to kick off the conference.

Tuesday, March 5, 2013

Continental Breakfast & Registration

7:45

Welcome

8:30

Robin Coffey, Director, Institutional Investor Memberships

Global Macro Overview

8:45

Zachary Karabell, President of River Twice Research, author, and television commentator will challenge the audience with his intriguing views on economic and political trends. Designated a “Global Leader for Tomorrow” by the World Economic Forum in Davos, Karabell will discuss issues ranging from the economic outlook in China and the U.S. to the concept of “sustainable excellence”.

9:15

The hedge fund industry continues to be a driving force in the investment world. The range of instruments and strategies pursued by hedge funds is expanding along with the number of hedge fund portfolios. But while many investors are increasing their allocation to hedge funds, others are having second thoughts after several years of mixed results from the hedge fund industry. Are the days of significant outperformance gone? What’s going on in this important segment of the investment world, and what does it mean for pension funds?

Ben Appen, Founding Partner, Magnitude Capital

Steve Bulko, CIO, 1798 Fundamental Strategies Fund, Lombard Odier Investment Management Clint Carlson, Chief Investment Officer and Founder, Carlson Capital, L.P.

David Harmston, Head of Client Group, Albourne America LLC

Gregory T. Williamson, Chief Investment Officer & Director, Trust Investments, BP America Inc.

Zachary Karabell, President , River Twice Research

Back to Basics in Hedge Funds

Coffee Break

10:15

Less than Zero

10:45

Corporate Funds Roundtable – Institutional Investor Institute

The hunt for yield is putting a squeeze on investors. With low interest rates here for the foreseeable future, how are corporate investment officers thinking about portfolio construction in light of their liability obligations? Fixed income’s dwindling return expectations and equities’ volatility are causing institutional investors to lean more heavily than ever on alternative investments. While the trend toward alternatives is old news, what’s new is the quickening pace. This session will explore how and why corporate plan sponsors are thinking about portfolio construction in both the short and long term.

11:45

Building on the morning sessions, breakout groups will discuss the latest trends in portfolio construction, dynamic asset allocation and hedge fund strategies.

Moderator: Joseph Nankof, Partner, Rocaton Investment Advisors, LLC

Douglas J. Brown, Senior Vice President & Chief Investment Officer, Exelon Corporation

Christopher K. Li, President and Chief Investment Officer, Lockheed Martin Investment Management Company Brian Pellegrino, Chief Investment Officer, United Parcel Service of America Inc.

Additional speakers to be announced.

Discussion Groups – Portfolio Construction

DISCUSSION GROUP LEADERS:

- Sanjay Chawla, Senior Director Asset Allocation & Canada Pension, Dow Chemical Company

Harlan Fabrikant Saroken, Managing Director, Marketing & Investor Relations, Perry Capital LLC

- Robert A. Thompson, Fixed Income Portfolio Manager, UPS Group Trust

Robert E. Fried, Senior Relationship Manager, Bridgewater Associates, LP

- Bas NieuweWeme, Senior Vice President, Head of Institutional Sales, ING Investment Management

Steve Deutsch, Director of Investment & Risk Management, Underwriters Laboratories, Inc.

- Mike Mikytuck, Director, Business Development, Benchmark Plus Management LLC

Co-leader to be announced.

Lunch & Featured Speaker

12:45

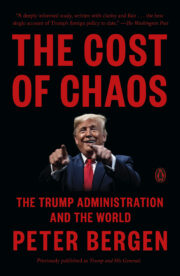

Peter Bergen, National Security Analyst, CNN and Best-Selling Author of Holy War, Inc. and Manhunt

2:15

One of the few Westerners to interview Osama bin Laden face-to-face, journalist Peter Bergen is the foremost authority on foreign policy, national security, and the new generation of terrorism that threatens the West. The CNN terrorism analyst’s most recent book is Manhunt: The Ten-Year Search for Bin Laden — from 9/11 to Abbottabad, an account that now forms the basis of a major motion picture due out later this year.

FEATURED BOOK

The Cost of Chaos: The Trump Administration and The World:

RECENT ARTICLES